Loading

Get Pacific Island Development Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pacific Island Development Bank online

This guide provides a clear and thorough approach to completing the Pacific Island Development Bank loan application form online. Follow the instructions outlined below to ensure your application is filled out accurately and efficiently.

Follow the steps to complete your application form.

- Click the ‘Get Form’ button to access the loan application form. This will allow you to fill in the necessary details in an efficient manner.

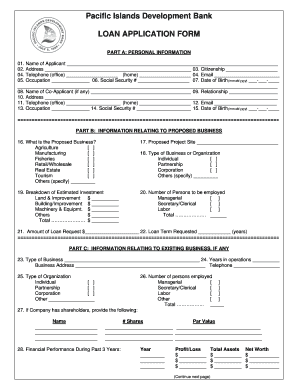

- Begin with Part A: Personal Information. Fill in your name, address, citizenship, telephone numbers, email, occupation, social security number, and date of birth. If applicable, provide the same details for a co-applicant.

- Proceed to Part B: Information Relating to Proposed Business. Here, specify the nature of your proposed business by selecting from options such as agriculture, manufacturing, or tourism. Additionally, provide the proposed project site and breakdown of estimated investments.

- Also in Part B, indicate the number of persons to be employed in various roles, as well as the type of business or organization it will be, including options like individual or partnership.

- In this part, detail the amount of loan request and the desired loan term in years.

- If applicable, move to Part C: Information Relating to Existing Business. Fill out the type of business, years in operation, business address, telephone number, type of organization, and number of persons employed. Provide details if your company has shareholders.

- Document the financial performance of the existing business over the past three years, including profits or losses, total assets, and net worth.

- Continue to Part D: Assets and list the assets currently owned by the applicant. Indicate their estimated value and whether they are mortgaged.

- Provide information on stocks, bonds, and estimated cash surrender value of insurance, if any.

- Complete Part E: Declaration by responding to questions about being a guarantor, pending suits or judgments, or previous bankruptcy filings.

- Finally, review the information provided for accuracy. Sign and date the certification section to acknowledge the truthfulness of your application.

- After completing the form, save your changes. You may also download, print, or share the form as needed.

Ensure your documents are ready by completing your application online today.

Today, NIC ASIA has 359 branches, 473 ATMs, 103 extension counters and 81 branchless banking. With A massive customer base and established reputation in the market, it has earned the title of the top bank in Nepal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.