Loading

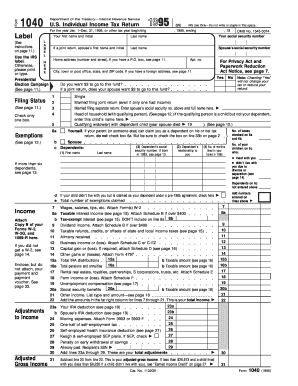

Get 1995 Form 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1995 Form 1040 online

Filling out the 1995 Form 1040 online allows users to efficiently report their income and claim deductions. This guide provides a clear, step-by-step approach to navigating each component of the form, ensuring a thorough and accurate online submission.

Follow the steps to successfully complete the 1995 Form 1040.

- Press the ‘Get Form’ button to access the document and open it in your preferred editing environment.

- Fill in your personal information in the top section, including your legal name and social security number. If filing jointly, also include your spouse's information.

- Choose your filing status by checking the appropriate box (e.g., single, married filing jointly, etc.). Ensure you review the criteria for each status before making your selection.

- Complete the exemptions section by indicating yourself, your spouse, and any dependents. Be mindful to include all necessary details, such as their names and social security numbers.

- In the income section, report all sources of income, including wages and interest. Ensure that you attach any required forms like W-2s or 1099s as needed.

- Proceed to the adjustments to income section. Here, you will document any applicable deductions that reduce your gross income.

- Calculate your total income and adjusted gross income by following the instructions closely. Keep an eye on the additional income types and their relevant forms.

- As you move to the tax computation section, determine your taxable income. Depending on your circumstances, decide if you'll use standard or itemized deductions.

- Document any applicable credits and other taxes after figuring your main tax amount. This will help in calculating your total tax obligation.

- Conclude by detailing your payments and any refund due. Ensure clarity on any amounts owed to avoid complications.

- Lastly, review all information entered for accuracy, sign the form, and save your changes. You can then download, print, or share the completed form as needed.

Now that you understand the steps, start completing your 1995 Form 1040 online for a streamlined filing experience.

Related links form

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.