Loading

Get 2021 W 4 Form Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2021 W 4 Form Oregon online

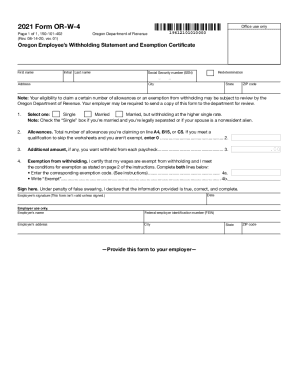

Filling out the 2021 W 4 Form Oregon is an essential step for ensuring accurate withholding from your paycheck. This guide will provide you with clear, step-by-step instructions to complete the form online, making the process seamless and straightforward.

Follow the steps to complete your W 4 Form efficiently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal information, including your first name, initial, last name, Social Security number, address, city, state, and ZIP code.

- Select your filing status by choosing one of the options: 'Single,' 'Married,' or 'Married, but withholding at the higher single rate.' Check 'Single' if you are married and legally separated or if your spouse is a nonresident alien.

- Indicate the total number of allowances you are claiming by entering the number on line 2. If you qualify to skip the worksheets and are not exempt, enter 0.

- If you wish to have an additional amount withheld from each paycheck, enter that amount on line 3.

- To claim an exemption from withholding, complete the necessary fields on lines 4a and 4b. Enter the corresponding exemption code and write 'Exempt' on the designated line.

- Sign and date the form. Remember, the form is not valid unless it is signed.

- Once you have filled out the form, you can save your changes, download it, print it, or share it as needed.

Complete your 2021 W 4 Form Oregon online today for accurate payroll withholding.

Related links form

Form OR-W-4 is designed to estimate the amount of tax you'll need to have withheld for Oregon. Your 2021 tax return may still result in a tax due or refund. For a more accurate calculation, use the Oregon Withholding Calcu- lator at www.oregon.gov/dor to calculate your allowances for Oregon.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.