Loading

Get Nj Annual Third Party Administrator Financial Reporting Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Annual Third Party Administrator Financial Reporting Requirements online

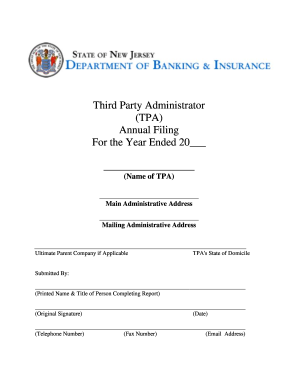

Completing the NJ Annual Third Party Administrator Financial Reporting Requirements is a crucial process for compliance with state regulations. This guide provides clear, step-by-step instructions to assist users in successfully filling out the required forms online.

Follow the steps to accurately complete the reporting requirements.

- Click ‘Get Form’ button to access the form and open it in your preferred editor. This will allow you to begin the completion of your financial reporting requirements.

- Start by filling out the TPA information section, including the name, main administrative address, mailing address, and if applicable, the ultimate parent company. Ensure all addresses are complete and accurate.

- Complete the annual questionnaire. This includes detailing the total amount received from benefit payers and attaching the required fidelity bond documentation. Use 'N/A' or 'None' where applicable.

- Proceed to fill out the annual contract report section. Document each benefits payer’s name, address, and the status of contracts in place. Include additional sheets if necessary.

- Ensure that the financial statements are prepared in accordance with GAAP and are submitted as required. If applicable, also include the parent company’s consolidated financial report.

- Review all entries for accuracy. Make sure that all required attachments, such as organizational charts and fidelity bonds, are included.

- Upon completion, save your changes, and review the document for any errors or omissions before submission.

- Once finalized, proceed to download, print, or share the completed form as required for submission to the designated mailing address.

Complete your NJ Annual Third Party Administrator Financial Reporting Requirements online today to ensure timely compliance.

Related links form

All businesses in New Jersey have an annual report that must be filed. The NJ annual report fee is $75. Even if you do not receive a notification from the state, you must file and a fee is required. Your report is due on the last day of the month in which you originally completed your business formation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.