Loading

Get 2796, Application For State Real Estate Transfer Tax (srett) Refund. 2796, Application For State

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2796, Application For State Real Estate Transfer Tax (SRETT) Refund online

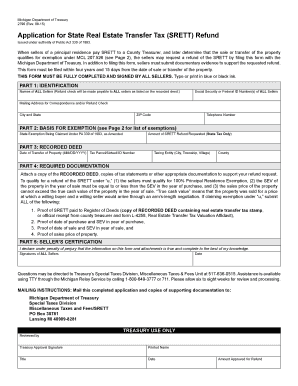

The 2796 form is a crucial document for individuals seeking a refund on the State Real Estate Transfer Tax. This guide will simplify the process of completing the application online, ensuring users can efficiently navigate each section.

Follow the steps to successfully complete your application.

- Press ‘Get Form’ button to access the document and open it for editing.

- In Part 1, provide identification details. Enter the names of all sellers, ensuring they exactly match the names on the recorded deed. Include each seller's Social Security or Federal ID number, and fill in the mailing address for correspondence or refund checks.

- For Part 2, specify the basis for exemption by indicating the amount of SRETT refund requested. Choose the appropriate state exemption being claimed under Public Act 330 of 1993 by referencing the exemptions listed on the second page of the form.

- In Part 3, accurately fill in the date of the property transfer in the MM/DD/YYYY format, provide the Tax Parcel/Sidwell ID number, along with the name of the taxing entity (city, township, village) and the county.

- For Part 4, attach all required documentation that supports your refund request. This includes a copy of the recorded deed, relevant tax statements, and any documentation needed to validate exemption claims, especially if claiming under exemption ‘u’.

- Complete Part 5 with the seller’s certification. All sellers must sign and date the form to assert that the information is true and complete to the best of their knowledge.

- Review the completed form for accuracy. Once verified, users can save changes, download, print, or share the form as needed.

Take action today and file your SRETT refund application online to ensure you receive your entitled refunds.

Related links form

How much are transfer taxes in California? Property transfer taxes are derived from the selling price of your home. The California Revenue and Taxation Code states that all the counties in California have to pay the same rate. The current tax rate is $1.10 per $1,000 or $0.55 per $500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.