Loading

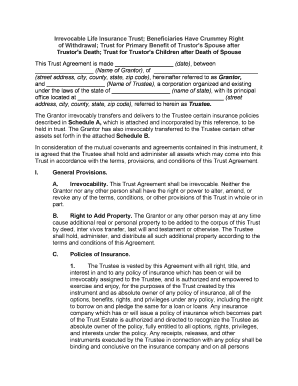

Get Irrevocable Trust Withdrawal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irrevocable Trust Withdrawal online

Navigating the process of completing an irrevocable trust withdrawal can seem daunting, especially without legal experience. This guide aims to provide clear, step-by-step instructions on how to fill out the form accurately and efficiently, ensuring you understand each component along the way.

Follow the steps to complete your irrevocable trust withdrawal process successfully.

- Begin by selecting the ‘Get Form’ button to access the Irrevocable Trust Withdrawal document. This action will prompt the form to open, making it accessible for input.

- In the first section, you will provide the date of the agreement and include the name of the grantor. Ensure you fill out your full street address, city, county, state, and zip code.

- Next, input the name of the trustee and their organizational details, including the corporation name and address. This information identifies the party responsible for managing the trust assets.

- You will then indicate the specific insurance policies being assigned to the trust, making sure to reference Schedule A for complete details.

- After that, describe any additional assets included in the trust as outlined in Schedule B. Provide thorough details to ensure clarity in the trust's composition.

- Regarding the irrevocability clause, reaffirm that the trust agreement cannot be amended. This section is crucial for the finality of the trust arrangement.

- Fill in sections pertaining to the right to add property and the policies of insurance. Be meticulous in detailing any insurance the trustee will manage, ensuring that rights and responsibilities are clearly outlined.

- As you reach the portions concerning distribution, clearly specify the entitlements of the grantor's spouse and children, including any conditions contingent upon their status.

- Once all sections are completed, review the entire form for accuracy. Errors can lead to misunderstandings and potential legal issues.

Take the first step in managing your trust by completing the Irrevocable Trust Withdrawal online today.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.