Get Sba Form 155 1998-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Form 155 online

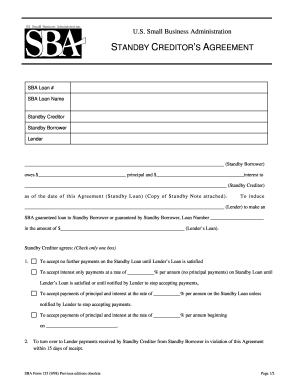

Completing the SBA Form 155 is a crucial step in securing a guaranteed loan from the SBA. This guide will provide you with clear instructions on how to fill out the form online, ensuring a smooth and successful application process.

Follow the steps to complete the SBA Form 155 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the SBA loan number and loan name accurately in the designated fields to identify the application. Ensure you have the correct information to avoid delays.

- Fill in the name of the standby creditor and standby borrower in the appropriate sections. It is important to use the full names as they appear in legal records.

- Indicate the principal amount owed by the standby borrower and the interest amount clearly. This should reflect the financial terms agreed upon between the parties involved.

- Select one of the options for payment acceptance by the standby creditor. Ensure that the chosen option aligns with your agreement and is checked accordingly.

- If applicable, provide the date when the standby creditor will start accepting payments of principal and interest, as well as the interest rate. Be precise to avoid ambiguity.

- Complete the section regarding lender rights. Ensure that the checkbox options reflect the agreement between the standby creditor and the lender.

- Fill in the date at the bottom of the form to signify when the agreement is being executed. This is vital for legal records.

- Finally, ensure that there is a signature from the standby creditor, along with the printed name. This will validate the agreement. After completing all sections, save your changes, and you have the opportunity to download, print, or share the form.

Complete your SBA Form 155 online today for a successful loan application.

SBA Form 155 is a critical document used by borrowers when applying for loans backed by the Small Business Administration (SBA). This form helps the SBA assess your financial needs and the risk associated with your application. By accurately completing SBA Form 155, you can facilitate a smoother approval process and enhance your chances of securing funding. Using platforms like uslegalforms can simplify the process of obtaining and completing the necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.