Loading

Get 1998 Form 540

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 540 online

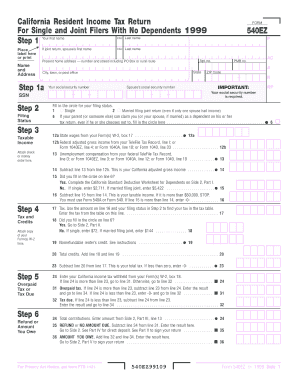

Filling out the 1998 Form 540 online is a critical step for California residents to accurately report their income and calculate their tax obligations. This guide will provide clear, step-by-step instructions to help you navigate the form efficiently.

Follow the steps to complete the Form 540 online.

- Click ‘Get Form’ button to obtain the form and access it in the digital document management system.

- Enter your first name and last name in the designated fields. Ensure that the names are spelled correctly, as they must match your social security records.

- Provide your social security number in the specified section. This is a required field, and it must be entered accurately to avoid processing delays.

- Select your filing status by marking the appropriate circle. You will need to specify whether you are single, married filing jointly, or if someone can claim you as a dependent.

- Report your taxable income by filling in the income figures from your Form(s) W-2 and any other applicable income sources. Make sure to follow any calculations indicated in the form.

- Calculate your deductions based on your filing status and any applicable worksheets. Enter the resulting values in the appropriate fields.

- Complete the tax calculation section by using the tax table provided in the instructions, applying your filing status and taxable income.

- Detail any tax credits you may be eligible for and accumulate any amounts in the relevant section.

- Determine whether you overpaid your taxes or owe taxes by subtracting your total tax from amounts withheld, and enter this information in the designated fields.

- If applicable, fill out the direct deposit information for your refund, including your bank account details.

- Sign and date the form in the appropriate areas. If filing jointly, ensure both partners sign the form.

- Lastly, review all entries for accuracy, save your changes, and utilize options to download, print, or share the completed form.

Start filling out your 1998 Form 540 online today to ensure timely and accurate tax compliance.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.