Loading

Get Form 100 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 100 online

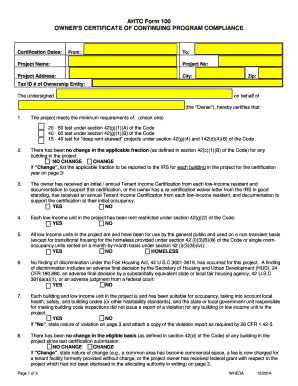

Filling out the Form 100 online can seem daunting, but with clear guidance, it can be a straightforward process. This form, the Owner's Certificate of Continuing Program Compliance, is essential for certifying that a project meets necessary requirements and regulations.

Follow the steps to complete the Form 100 effectively

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the certification dates, including the 'From' and 'To' dates, along with the project name, project number, and project address.

- Input the Tax ID number of the ownership entity in the designated field.

- In the certification section, indicate whether the project meets the minimum requirements by checking the applicable box for the 20-50 test, 40-60 test, or 15-40 deep rent-skewed test.

- State whether there has been a change in the applicable fraction by selecting 'No Change' or 'Change.' If 'Change' is selected, list the new applicable fraction for each building in the project on page 3.

- Confirm receipt of annual Tenant Income Certification for each low-income resident, selecting 'Yes' or 'No.'

- Indicate whether each low-income unit has been rent-restricted under section 42(g)(2) by checking 'Yes' or 'No.'

- Certify that all low-income units have been used by the general public and on a non-transient basis by selecting 'Yes' or 'No,' specifying if it is for homeless purposes.

- Confirm that no findings of discrimination under the Fair Housing Act have occurred by selecting 'Yes' or 'No.'

- Certify that each building and low-income unit is suitable for occupancy and check that no violations have been reported by selecting 'Yes' or 'No.' If 'No,' state the nature of the violation on page 3.

- Indicate if there has been a change in the eligible basis since the last certification by clicking 'No Change' or 'Change' and providing details if applicable.

- Ensure that all tenant facilities included in the eligible basis were provided without charge to all tenants by selecting 'Yes' or 'No.'

- Confirm whether reasonable attempts were made to rent any vacant low-income units by selecting 'Yes' or 'No.'

- State whether the next available unit for low-income tenants was offered to residents with a qualifying income if previous tenants exceeded income limits, by selecting 'Yes' or 'No.'

- Confirm adherence to the extended low-income housing commitment by selecting 'Yes,' 'No,' or 'N/A.'

- Verify if the owner received tax credits from a qualified non-profit organization and determine if the non-profit needs to complete the addendum, selecting 'Yes,' 'No,' or 'N/A.'

- Finally, confirm if there has been any change in ownership or project management by selecting 'No Change' or 'Change' and providing additional information if required.

- Complete the signature section by printing the owner’s name, adding the owner's signature, and dating the form.

- Review all entries for accuracy before finalizing your submission.

- Once complete, you can save changes, download, print, or share the form as needed.

Start filling out your Form 100 online today to ensure compliance and smooth processing.

2021 Form 100 California Corporation Franchise or Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.