Loading

Get Certificate Of Non Foreign Status

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate of Non Foreign Status online

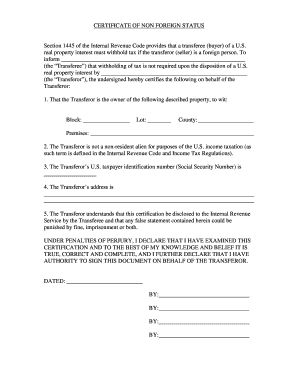

Filling out the Certificate of Non Foreign Status is a crucial step in ensuring proper tax compliance when dealing with U.S. real property interests. This guide provides clear instructions on how to complete this form online, ensuring that you understand each component and its significance.

Follow the steps to complete the Certificate of Non Foreign Status online

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- In the designated space, enter the name of the Transferee (buyer) who is required to provide this certificate.

- Next, provide the name of the Transferor (seller) who is certifying their status.

- Specify the property details, including Block, Lot, County, and Premises. This information identifies the real property involved in the transaction.

- Indicate that the Transferor is not a non-resident alien for U.S. income taxation purposes, ensuring compliance with tax regulations.

- Enter the Transferor’s U.S. taxpayer identification number (Social Security Number). This is critical for the IRS records.

- Fill in the Transferor's complete address in the designated section to ensure accurate communication.

- Review the certification statement thoroughly to confirm that all entered information is accurate and complete. Understand the implications of false statements.

- Ensure the document is signed and dated by the appropriate person authorized to act on behalf of the Transferor.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Complete your documents online to ensure accuracy and compliance.

Non-residency refers to a status where an individual or entity does not reside in a specific jurisdiction for tax purposes. This status affects tax liabilities and obligations in many ways. Understanding your non-residency status can help you navigate complex tax regulations and avoid unnecessary penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.