Loading

Get Premiere Select Simple Ira Plan Salary Reduction Agreement Form 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Premiere Select Simple IRA Plan Salary Reduction Agreement Form online

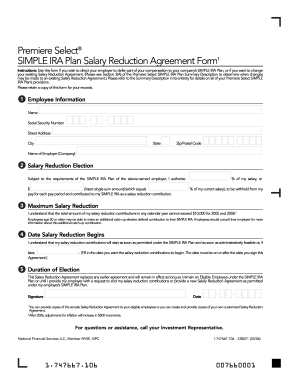

Filling out the Premiere Select Simple IRA Plan Salary Reduction Agreement Form online is an essential step for directing your employer to defer part of your compensation into your company's SIMPLE IRA Plan. This guide provides clear and detailed instructions on how to complete each section of the form correctly.

Follow the steps to complete your Salary Reduction Agreement Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employee information in the designated fields. This includes your name, social security number, street address, city, state, zip/postal code, and the name of your employer.

- In the salary reduction election section, specify the amount you wish to defer as a salary reduction contribution. You can enter a single-sum amount or a percentage of your salary. Ensure that this amount complies with the SIMPLE IRA Plan requirements.

- Before filling out the maximum salary reduction section, review the limits for your contributions. For the years 2005 and 2006, ensure that your total contributions do not exceed $10,000 unless you are eligible for the catch-up contribution if you are age 50 or older.

- Indicate the start date for your salary reduction contributions. This date should be on or after the date you are signing the agreement.

- Review the duration of the election to ensure you understand how long this agreement will remain in effect. Confirm that this Salary Reduction Agreement will replace any prior agreements.

- Finally, sign the form, fill in the date, and ensure you keep a copy for your records. After ensuring all fields are accurately filled, you can save your changes, download the form, print it, or share it as needed.

Complete your Premiere Select Simple IRA Plan Salary Reduction Agreement Form online today!

A 403(b) plan may allow: Elective deferrals - employee contributions made under a salary reduction agreement. The agreement allows an employer to withhold money from an employee's salary and deposit it into a 403(b) account. ... The employee pays income tax on these contributions only when they are withdrawn.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.