Loading

Get Ph Bir 1700 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1700 online

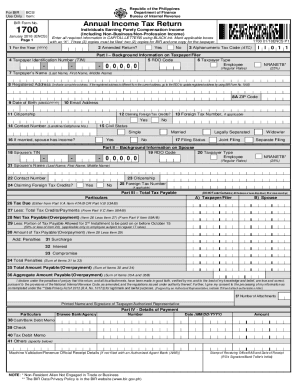

Filling out the PH BIR 1700 form online is a straightforward process that allows individuals earning purely compensation income to report their annual tax obligations. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete your annual income tax return online

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the Year in YYYY format. Indicate if this is an amended return by marking the applicable box. Input your alphanumeric tax code.

- Fill out your background information including your RDO code, taxpayer type, and taxpayer identification number (TIN). Write your full name as per your identification documents, and complete the registered and current address, including the ZIP code.

- Provide your date of birth in MM/DD/YYYY format and email address. If you are claiming foreign tax credits, mark the appropriate box and indicate your citizenship.

- If applicable, fill in your contact number and civil status, and specify if your spouse has any income. Include your spouse’s TIN if you are filing jointly.

- In Part II, provide similar details for your spouse, including their taxpayer type and name.

- Move to Part III to calculate the total tax payable. Input figures starting from the tax due, subtract tax credits/payments, and find the net tax payable or overpayment.

- In Part V, complete the computation of tax, ensuring you fill either the graduated rates or flat rates sections as applicable. Be precise with figures, and round amounts when necessary.

- List any tax credits/payments you are claiming attached with proof documents and calculate total tax credits.

- In Part VI, fill in the details of your gross compensation income and tax withheld. Ensure total gross compensation and tax withheld for you and your spouse are clearly stated.

- Finally, review your entries for accuracy, save the changes, and then download, print, or share the completed form as required.

Complete your documents online today for a smoother filing experience.

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.