Loading

Get Ph Bir 2316 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2316 online

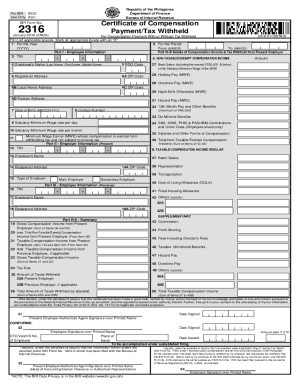

The PH BIR 2316 is a critical document for individuals in the Philippines receiving compensation, serving as a certificate of compensation payment and tax withheld. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring you accurately report your income and taxes.

Follow the steps to fill out the PH BIR 2316 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax year you are reporting in the 'For the Year' section, and specify the period for which the form applies, listing the start and end dates (From and To) in MM/DD/YYYY format.

- Fill in the Employee Information section (Part I) by providing your Tax Identification Number (TIN), your full name (last name, first name, middle name), the Revenue District Office (RDO) Code, and your registered address including ZIP code.

- Complete Part IV-B by detailing your compensation income and tax withheld from your present employer. List all amounts in the designated fields, marking non-taxable or exempt compensation income.

- Input your date of birth and contact number in the respective fields of Part I. Ensure accuracy as this information is essential for your records.

- In Part II, provide your current employer's information, including their TIN, name, address, and type of employer. Specify if they are your main or secondary employer.

- If applicable, include details from any previous employers in Part III to account for all income sources during the reporting period.

- Summarize your gross compensation income and deductions in Part IVA to calculate your taxable compensation income.

- Finally, review all inputs for accuracy, and once complete, save your changes and either download, print, or share the filled form as necessary.

Complete your PH BIR 2316 online today to ensure your tax compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

1. If you lost your latest copy of BIR Form 2316 and you need it for your credit card/visa/loan application. You won't be able to get another copy from your employer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.