Loading

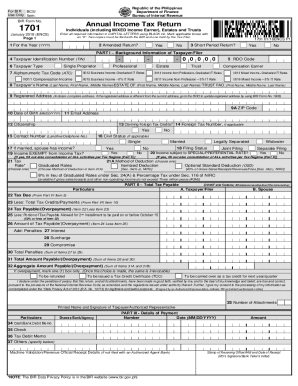

Get Ph Bir Form 1701 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 1701 online

Filing your annual income tax return can be straightforward with the right guidance. This guide will walk you through the essential steps to complete the PH BIR Form 1701 online accurately and efficiently.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the required information. In Part I, provide your taxpayer identification number (TIN), tax type, alphanumeric tax code, and personal information such as your name, registered address, date of birth, email address, and contact number. Ensure to complete each field in capital letters using black ink as instructed.

- In Part II, calculate your total tax payable. Fill in your tax due based on the gross income reported in the previous sections. Subtract any applicable credits or payments to arrive at the final amount that may be payable or any overpayment due.

- Complete Part III with payment details, including cash transactions, checks, or other methods of payment. Retain copies of payment proofs as they may be required later.

- Proceed to any additional sections relevant to your filing status, such as deductions or special tax credits, as you move through Parts IV to IX.

- Finally, review all information for accuracy, save your changes, and choose to download, print, or share the completed form as required.

Start filling out your BIR Form 1701 online today to ensure timely and accurate tax filing.

Related links form

What Is the Difference Between Form 1701 and 1701A? The main difference between the forms is that form 1701 is for those with mixed-income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.