Loading

Get W9 Resale Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9 resale certificate online

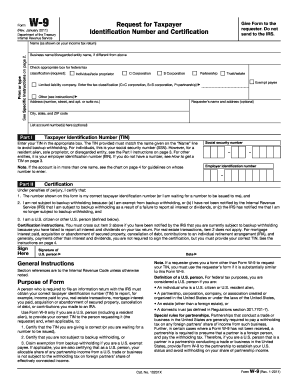

The W9 resale certificate is an essential document for U.S. persons to report their taxpayer identification number to the requester. This guide will walk you through the steps to complete the W9 resale certificate online, ensuring accuracy and compliance.

Follow the steps to complete your W9 resale certificate online.

- Press the ‘Get Form’ button to access the W9 resale certificate document and open it in your preferred editor.

- Begin by entering your name as shown on your income tax return in the designated field. If you have a business or disregarded entity name, provide that in the next field.

- Check the appropriate box that corresponds to your federal tax classification. The options are individual/sole proprietor, C corporation, S corporation, partnership, trust/estate, exempt payee, or limited liability company (LLC). If you select LLC, indicate its tax classification.

- Next, provide your address, including street number, apt. or suite number, city, state, and ZIP code. Optionally, you can list the requester's name and address if required.

- In Part I, enter your taxpayer identification number (TIN). For individuals, this is your social security number (SSN). For other entities, such as corporations, this is your employer identification number (EIN). Ensure that the TIN matches the name provided to prevent backup withholding.

- In Part II, read the certification statements carefully. Confirm that the information you provided is correct and check if you are subject to backup withholding. You must cross out item 2 if you have been notified by the IRS that you are subject to backup withholding.

- Sign and date the form, verifying your identity as a U.S. person. Ensure that the signature fits the name provided at the top of the form.

- Once all sections are filled out, review the document for accuracy. Save your changes, and you can choose to download, print, or share the completed W9 resale certificate as needed.

Complete your W9 resale certificate online today to ensure timely and accurate tax reporting.

A W-4 form requires some of the same information as a W-9, like your name, address and Social Security number. These forms also request information on tax exemptions. ... Since an employer doesn't withhold income tax for contract and freelance employees, W-9 forms don't request that information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.