Loading

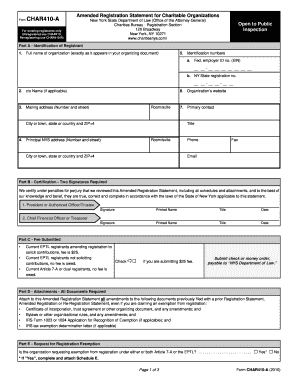

Get Char 410a Nys

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Char 410a Nys online

Filling out the Char 410a Nys form online is a crucial step for organizations seeking to register or amend their charitable status in New York. This guide provides clear and detailed instructions to help you navigate the process with ease.

Follow the steps to complete the Char 410a Nys form online.

- Click ‘Get Form’ button to access the Char 410a Nys form and open it in your browser.

- In Part A, enter the full name of your organization exactly as it appears in your organizing document. Also, include your federal employer ID number, state registration number, and the organization’s website if applicable.

- Provide the mailing address of your organization, including any room or suite numbers, city, state, and ZIP+4 code. Additionally, fill in the principal New York State address with the same details.

- In this section, you need to provide the primary contact information, including their title, phone number, fax, and email address.

- Part B requires two signatures for certification. Both signers must print their names, titles, and dates next to their signatures.

- In Part C, if applicable, indicate whether you are submitting a fee by checking the appropriate box based on your organization’s registration status.

- Part D involves attaching all necessary documents as outlined. Ensure that all amendments to previously filed documents are included.

- Part E asks if your organization is requesting an exemption from registration. Select ‘Yes’ or ‘No’ and provide additional information if ‘Yes’ is selected.

- In Part F, provide details on organizational structure changes since the last filing. You must also list all chapters, branches, and affiliates.

- Part G asks for updates related to organization activities and requires details about fundraising professionals engaged by your organization.

- Finally, in Part H, provide any updates to your organization's federal tax-exempt status, including dates and IRS information as needed.

- Once all fields in the form have been completed correctly, save your changes. You can then download, print, or share the form as necessary.

Complete your Char 410a Nys form online today for a seamless registration experience.

EPTL: Section 8-1.4 of the Estates, Powers and Trusts Law (EPTL) requires registration of charitable organizations that are incorporated, are formed or otherwise conduct activity in New York State. ... Dual: Organizations registered pursuant to both Article 7-A and the EPTL.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.