Loading

Get Ar1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1 Form online

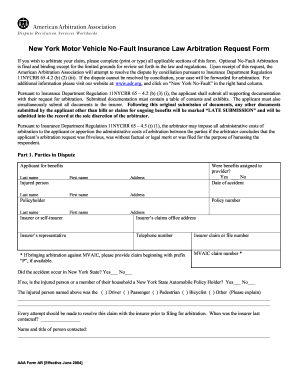

Filling out the Ar1 Form online is a straightforward process designed to facilitate your application for arbitration under the New York Motor Vehicle No-Fault Insurance Law. This guide provides a clear pathway through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the Ar1 Form online

- Click ‘Get Form’ button to retrieve the Ar1 Form and open it in your chosen application.

- Begin by providing your personal information in Part 1, including your last name, first name, and address. Make sure to specify if benefits were assigned to a provider by selecting either 'Yes' or 'No' and include the date of the accident.

- Proceed to fill in the details of the injured person and the policyholder. Ensure you enter their last and first names along with their addresses. Indicate whether the accident occurred in New York State by choosing 'Yes' or 'No' and complete the necessary details based on your selection.

- In Part 2, indicate your preferences for special handling of the case. Answer whether you wish to proceed with written submissions, a telephone hearing, or priority arbitration. Each response should be marked clearly with 'Yes' or 'No'.

- Move on to Part 3, where you will detail the claims in dispute. For medical claims, attach the necessary bills, documents, and specify any additional claims. Make sure to fill out the totals for each section, as incomplete submissions may be returned.

- Before submitting your form, review all sections to confirm that all necessary information and supporting documents are included, particularly ensuring you have a table of contents and all exhibits attached.

- Finally, you will save your changes, then download, print, and share the completed form as necessary to submit your application for arbitration.

Complete your Ar1 Form online today and ensure you follow the procedures for effective arbitration.

Phone: 1-800-829-3676 to request tax forms, instructions & publications; 1-877-777-4778 to speak with the Taxpayer Advocate Service. IRS TaxFax: 1-703-368-9694 to obtain tax forms by fax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.