Loading

Get 1994 Form 540

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1994 Form 540 online

This guide provides clear instructions on how to complete the 1994 Form 540 online. Follow the steps outlined below to ensure that you accurately fill out your California resident income tax return.

Follow the steps to complete the Form 540 online.

- Click ‘Get Form’ button to download the 1994 Form 540 and open it in the editor.

- Enter your name and address in the designated fields at the top of the form. If you received a pre-printed label, attach it in the specified area.

- Select your filing status by checking the appropriate box (Single, Married Filing Joint, etc.) in Step 2.

- Fill in the exemptions section. If you or your spouse can be claimed as a dependent by someone else, check the appropriate box.

- Input your federal adjusted gross income (AGI) in the designated field in Step 4.

- Indicate your standard or itemized deductions based on your circumstances. Use the Standard Deduction Worksheet if applicable.

- Calculate your taxable income by subtracting your deductions from your AGI.

- Determine your tax using the provided tax table or tax rate schedules.

- Enter any applicable credits you are eligible for in Section 6 of the form.

- Calculate the total tax due or refund owed by following the prompts in Step 9.

- Review all entered information for accuracy, ensuring that no fields are left blank.

- Save your changes, download a copy of the filled form, print it, or share it with the necessary parties.

Don’t wait—complete your 1994 Form 540 online today to take advantage of potential refunds and ensure compliance with tax regulations.

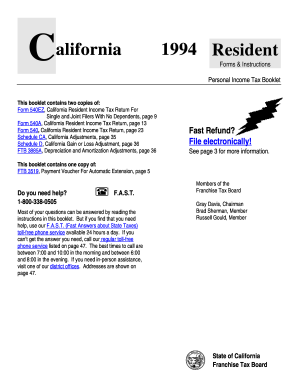

A Form 540 is also known as a California Resident Income Tax Return. This form will be used for tax filing purposes by citizens living and working in the state of California. This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.