Loading

Get Form 56

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 56 online

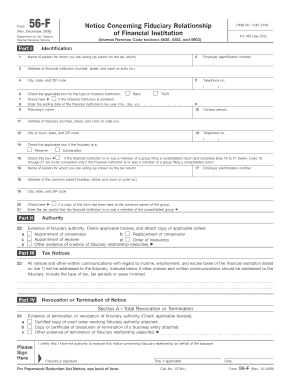

Filling out Form 56 is an important step in notifying the IRS of a fiduciary relationship concerning a financial institution. This guide provides clear and comprehensive instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the Form 56 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Complete Part I, Identification. Enter the name of the person for whom you are acting as fiduciary, followed by their employer identification number, address, and contact information. Ensure all details are accurate to avoid delays.

- Indicate whether the financial institution is insolvent by checking the applicable box if it is. Provide the ending date of the financial institution's tax year.

- Fill in the fiduciary's name and address in lines 9-13. Include the contact person's information for any tax matters related to the financial institution.

- If applicable, check the box for the fiduciary's membership in a consolidated group and complete lines 16 to 21 accordingly, including details of the common parent and the tax years involved.

- In Part II, Authority, check the appropriate box indicating your fiduciary authority and attach copies of any necessary orders.

- Complete Part III regarding Tax Notices, specifying any different addresses for tax communications if necessary.

- In Part IV, provide details for revocation or termination of any prior notices if applicable.

- Sign the form, including your title, to certify that you have the authority to execute this notice.

- Once all sections are completed, you can save your changes, download a copy of the form, print it for your records, or share it as required.

Begin filling out important documents online to stay compliant and organized.

Form 1041 (fiduciary tax return) is the income tax form used for estates and trusts. It is used to report INCOME in the estate or trust, including sales of property. The estate or trust exists until final distribution of its assets. ... A calendar year is required for trust returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.