Loading

Get Bare Trust Agreement Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bare Trust Agreement Template online

Filling out a Bare Trust Agreement Template online can seem daunting, but with a clear understanding of its components, you can complete the process smoothly. This guide provides step-by-step instructions to assist you in filling out the form correctly.

Follow the steps to complete the Bare Trust Agreement Template effectively.

- Click the ‘Get Form’ button to access the Bare Trust Agreement Template and open it in your preferred editor.

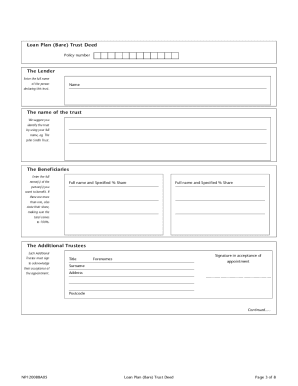

- In the 'The Lender' section, enter the full name of the person declaring the trust. This name should reflect the individual who is lending and creating the trust.

- Specify the name of the trust. It is recommended to use your full name to identify the trust, for example, 'The John Smith Trust'.

- In 'The Beneficiaries' section, record the full name(s) of the person(s) who will benefit from the trust. If there are multiple beneficiaries, indicate each person’s specified percentage share, ensuring that the total equals 100%.

- List the Additional Trustees by entering their titles, full names, and addresses. Each Additional Trustee must sign the document to acknowledge their acceptance of the appointment.

- In the Declaration section, read through the terms carefully, affirming the lender's intentions and the trustees' agreements.

- The Lender must sign the document in the presence of a witness. Both the Lender's and the witness's full names and addresses must be recorded.

- Complete the Loan Agreement part by stating the amount of the loan. The Lender must agree that the loan will not be secured by any asset of the trust and must sign as a deed with a witness present.

- The Trustees, including the Lender, must sign the Trustees' Agreement to authorize the Lender to pay the loan directly to the intended life assurance policy provider.

- Review all entries for accuracy, then save your changes, download, print, or share the completed Bare Trust Agreement Template as needed.

Start filling out your Bare Trust Agreement Template online today to ensure an efficient and effective trust setup.

A bare trust is a legal structure that facilitates the division of the beneficial and legal ownership. Typically a bare trust is the use of a company to hold the legal or registered title to property as nominee, in trust for the real or beneficial owner of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.