Loading

Get Form Or-131

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form OR-131 online

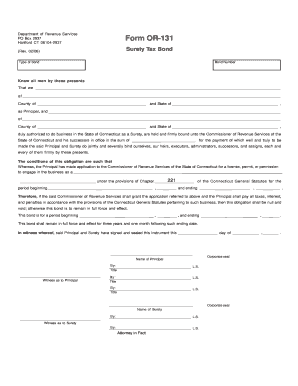

Filling out the Form OR-131, a surety tax bond, is a crucial step for those seeking to engage in specific business activities in Connecticut. This guide provides a clear, step-by-step approach to completing the form online, ensuring you meet all requirements accurately.

Follow the steps to successfully complete the Form OR-131 online.

- Press the ‘Get Form’ button to acquire the Form OR-131. This will enable you to open the document in your preferred editor.

- Begin by filling in the type of bond at the top of the form. Ensure that you enter the correct bond number corresponding to your application.

- The next section requires the name of the Principal, which includes the complete name and address. Ensure that the County and State fields are filled accurately for proper identification.

- Fill in the information for the Surety, including the name, address, County, and State, just as you did for the Principal.

- In the outlined section, indicate the license, permit, or permission type the Principal is applying for. Be specific about the business activities to clarify the intention behind the bond.

- Next, provide the date range for which the bond is effective, ensuring that you specify both the beginning and ending dates correctly.

- Sign and date the form where indicated. Ensure that all required signatures from the Principal, Surety, and any witnesses are captured to meet legal standards.

- Once you have completed all sections and confirmed accuracy, you can save your changes, download a copy for your records, print for physical submission, or share directly as needed.

Complete your Form OR-131 online today to ensure your business operations in Connecticut are compliant and fully authorized.

Lance Surety Bonds can help you get any type of Connecticut surety bond you need. If you know the type of bond you want to get, you can find it in the bond table below and click “Apply now.” Or, call us at (877) 514-5146 if you need further assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.