Loading

Get Schedule Or Tse Ap

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Schedule Or Tse Ap online

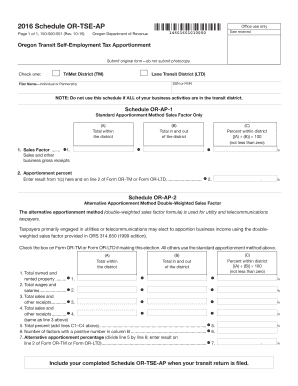

The Schedule Or Tse Ap is an essential document for individuals and partnerships engaged in transit self-employment in Oregon. This guide provides comprehensive, step-by-step instructions to help users fill out the form accurately and efficiently, ensuring compliance with state requirements.

Follow the steps to successfully complete the Schedule Or Tse Ap online.

- Press the 'Get Form' button to access the Schedule Or Tse Ap and open it in your chosen editor.

- Identify the appropriate transit district by checking either the TriMet District or Lane Transit District box. This selection is crucial as it determines your apportionment method.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field. This step is vital for accurate identification and processing.

- Fill in the Filer Name section. Specify whether the filer is an individual or a partnership, as this affects tax calculations.

- Complete the sales factor section (Schedule OR-AP-1). Enter the total sales within the district in column A and total sales in and outside the district in column B.

- Calculate the percent within the district by dividing the total sales within the district (column A) by the total sales in and outside the district (column B), then multiply by 100. Enter this result in column C.

- Transfer the result from the sales factor calculation to line 2 of the relevant Form OR-TM or Form OR-LTD, as instructed.

- If applicable, complete the alternative apportionment method section (Schedule OR-AP-2). For utility and telecommunications taxpayers, enter figures for property, payroll, and sales as specified.

- Determine the alternative apportionment percentage by summing the percentages calculated in the alternative apportionment section and dividing by the number of factors with a positive number.

- Ensure all calculations are accurate and rounded as per the instructions. Save your changes to the document, then download or print the completed form.

- Include the completed Schedule Or Tse Ap with your transit return when filing to ensure compliance.

Start filling out your Schedule Or Tse Ap online today to ensure timely submission and compliance with Oregon tax regulations.

Schedule OR‑AP is used for all corporations and partner‑ ships that are doing business in more than one state and may be used with Forms OR‑20, OR‑20‑INC, OR‑20‑INS, OR‑20‑S, and OR‑65. Oregon income is the total of the business entity's appor‑ tioned and allocated income assigned to Oregon.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.