Loading

Get Canada Form T2151

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Form T2151 online

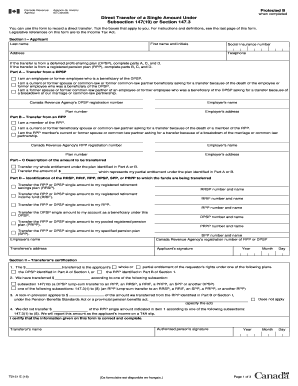

Filling out the Canada Form T2151 is an important step for individuals or beneficiaries looking to record a direct transfer of a single amount under subsection 147(19) or section 147.3. This guide provides a step-by-step approach to fill out the form online, ensuring a smooth and accurate process.

Follow the steps to complete the Canada Form T2151 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section I, which is for the applicant. Fill in your last name, first name, initials, social insurance number, telephone number, and address.

- Next, determine the source of your transfer. If it is from a deferred profit-sharing plan (DPSP), complete Parts A, C, and D. If it is from a registered pension plan (RPP), complete Parts B, C, and D.

- For Part A (if transferring from a DPSP), indicate your relationship to the employee or former employee, provide their Canada Revenue Agency's registration number, employer's name, plan number, and employer's address.

- For Part B (if transferring from an RPP), similarly, indicate your relationship to the member, alongside their Canada Revenue Agency's registration number, employer's name, plan number, and employer's address.

- In Part C, specify the amount to be transferred. You may choose to transfer your whole entitlement or specify a partial amount.

- In Part D, indicate to which account the funds will be transferred, providing the corresponding account details including RRSP, RRIF, RPP, DPSP, SPP, or PRPP numbers and names.

- Proceed to sign and date the form in the designated area.

- Ensure all sections have been accurately completed and reviewed. Save your changes, and depending on your needs, download, print, or share the form accordingly.

Complete your Canada Form T2151 online today for a seamless transfer experience.

T2033 Direct Transfer Between Institutions | Savings. Page 1. 1 of 1. This form is used to request a direct transfer under subsection 146.3(14.1) or 146(21) or paragraph 146(16)a) or 146.3(2)e) of the Income Tax Act of Canada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.