Loading

Get About Schedule C

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the About Schedule C online

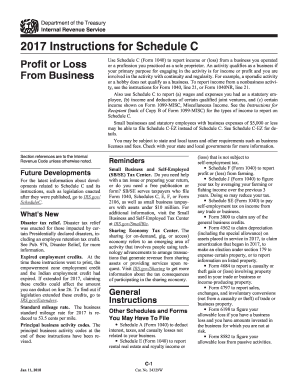

Filling out Schedule C is an essential task for sole proprietors to report income or loss from their business activities. This guide provides clear, step-by-step instructions on completing the form online, ensuring you have all the information you need.

Follow the steps to complete your Schedule C effectively.

- Click the ‘Get Form’ button to obtain the Schedule C and open it in the editor.

- Begin with Line A, where you need to describe the business or professional activity that is your principal source of income. Be specific about the type of service or product provided.

- For Line B, enter the six-digit code that corresponds to your business activity using the provided Principal Business or Professional Activity Codes.

- On Line D, provide your employer identification number (EIN). If you do not have one, leave this line blank.

- Fill out Line E with your business address, ensuring to include the street address and room or suite number.

- Select your accounting method on Line F. This is crucial as it impacts how you report income and expenses.

- For Line G, indicate whether you materially participated in the business. This impacts how your income or losses may be classified.

- Complete Line H if you started or acquired this business in the current tax year or are restarting a previously closed business.

- On Line I, check if you made any payments that require filing Forms 1099. This is important for compliance.

- In Part I, report your income on Line 1 from your business. Include gross receipts and any income shown on Forms 1099-MISC.

- Proceed to Part II to list all allowable business expenses in the appropriate lines, including costs related to car expenses, contract labor, and utilities.

- Finalizing, check Line 31 to calculate your net profit or loss. Ensure to apply any necessary limitations based on passive activity loss rules.

- Once complete, you can save your changes, download, print, or share the Schedule C as needed.

Complete your Schedule C online to ensure accurate reporting of your business income and expenses.

Step 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. ... Step 2: Calculate Gross Profit and Income. ... Step 3: Include Your Business Expenses. ... Step 4: Include Other Expenses and Information. ... Step 5: Calculate Your Net Income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.