Loading

Get Form 12s 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12s 2018 online

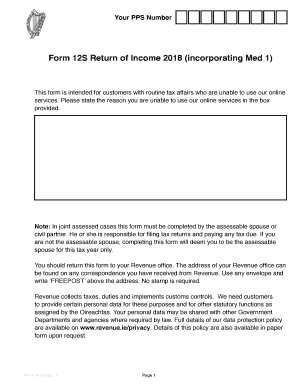

This guide provides clear, step-by-step instructions for filling out the Form 12s 2018 online. Designed for individuals with routine tax affairs, this simplified return is user-friendly and ensures that all necessary information is accurately submitted.

Follow the steps to complete your Form 12s 2018 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in your personal details in the designated fields. This includes your name, address, Eircode, date of birth, and information about your spouse or civil partner, if applicable.

- In the Employment / Pension Details section, provide the necessary information about your employment or pension income. If you or your spouse has multiple employers or pensions, use the additional fields available.

- Complete the Payments from the Department of Employment Affairs and Social Protection section by entering any applicable payments received. Ensure that you provide accurate amounts for each payment type.

- For the Other Income not subject to PAYE section, input any untaxed income and interest received, making sure to distinguish between the different types.

- If you or your spouse has foreign pensions or income, detail this information in the Foreign Pensions / Income section, entering all amounts in Euro.

- In the Health Expenses Relief section, provide information on qualifying health expenses and ensure that all entries are detailed accurately.

- Complete the Tax Credits, Allowances and Reliefs section by indicating eligibility for specific tax credits available to you and your spouse.

- Review the Declaration section before signing. Ensure that all provided information is truthful and complete to avoid penalties.

- Finally, submit your completed form online. You may then save changes, download, print, or share the form as necessary.

Begin completing your Form 12s 2018 online now to ensure timely submission and compliance.

This Income Tax Return (Form 12) is to be completed by a person whose main source of income is from a PAYE employment or pension or a non-proprietary company director who pays all his / her income tax under the PAYE system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.