Loading

Get Ir 25

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir 25 online

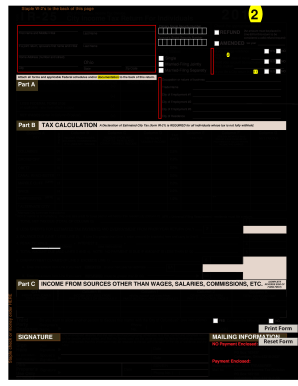

The Ir 25 form is essential for individuals to report their income and calculate tax liabilities for the City of Columbus. This guide provides a clear, step-by-step approach to completing the form online, ensuring you have the necessary information for accurate filing.

Follow the steps to complete the Ir 25 form easily and accurately.

- Click ‘Get Form’ button to access the Ir 25 form and open it in your preferred editor.

- Fill in your primary social security number and personal information, including your first name, last name, and, if applicable, your spouse's details. Make sure to check the appropriate box regarding your filing type (refund, amended).

- Indicate your filing status by selecting from the options provided, such as single or married filing jointly. Add your home address, including city, state, and zip code.

- In the income section, report your various sources of income, including wages, commissions, and other taxable income. Fill in the net wages from your W-2 forms as applicable and attach them to the back of the document.

- Calculate your total net taxable income. Make sure to account for tax withheld and any deductions, as outlined in the instructions.

- Review all sections, including the tax calculation and overpayment information. If you are due a refund, include the desired amount and whether it will be credited or refunded.

- Once the form is completed, ensure all relevant sections are signed. You can then save the form changes, download a copy for your records, print the document, or share it as needed.

Take control of your tax responsibilities and complete your Ir 25 form online today!

2021 Filing Season Information The deadline for filing 2020 individual tax returns is May 17, 2021. ... Admissions Tax Effective July 1, 2019, the City of Columbus will levy a 5% tax on amounts received as admission to any place located within the City of Columbus. For more details and resources, please click here.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.