Loading

Get National Zakat Foundation Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the National Zakat Foundation Application Form online

Filling out the National Zakat Foundation Application Form online can be a straightforward process if you follow the right steps. This guide will help you understand the components of the form and provide a detailed walkthrough to ensure you complete it accurately.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

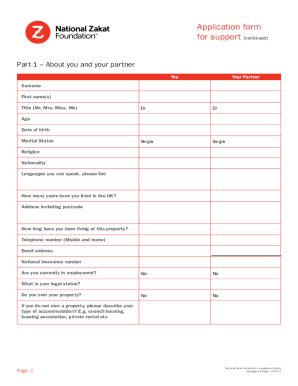

- Begin with Part 1, which requires information about you and your partner. Fill in your names, titles, ages, marital status, and contact information accurately. Ensure you provide your national insurance number and describe your accommodation type if you do not own a property.

- Move to Part 2 to provide details about any children living with you. Include their names, dates of birth, and any child benefits received. If no children live with you, proceed to Part 4.

- In Part 3, list any additional people residing with you. Remember to attach proof of ID for all individuals mentioned.

- Part 4 covers your assets. Provide details regarding your bank accounts, cash on hand, investments, and any properties beyond your primary residence.

- In Part 5, document your outstanding debts. List bank overdrafts, credit cards, and any other personal debts you may have.

- Part 6 inquires about disabilities. Indicate if you or your partner have a disability and if you receive any related benefits.

- Next, in Part 7, you will need to declare your monthly income from various sources, including employment, benefits, and any other forms of income.

- In Part 8, provide your monthly expenses, ensuring to itemize costs such as rent, utilities, food, and transportation.

- Part 9 asks if you have applied for support from other organizations. Fill in the necessary details if applicable.

- In Part 10, enter the names and contact information of your referees. They must be professional references and not family members.

- Part 11 requires you to explain your situation and specify how you hope NZF can assist you.

- Finally, ensure to read the declaration, sign, and date the application. This is crucial, as incomplete applications may not be processed.

- Once your form is complete, scan and email it or post it, ensuring all supplementary documents are included as photocopies only.

Complete your application form online today for support from the National Zakat Foundation.

Related links form

If you meet the criteria to receive Zakat as determined by the UAE's Zakat Fund, you can request for zakat online. You can also apply for a petition to restudy your case if your request was rejected or the amount allocated is insufficient. You can check processing time for each service in the service card itself.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.