Loading

Get T777 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T777 Form online

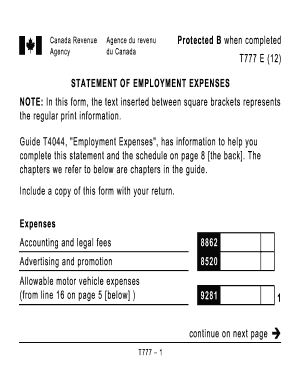

The T777 Form, also known as the Statement of Employment Expenses, is a crucial document for individuals looking to claim employment-related expenses. This guide will provide clear and comprehensive steps on how to fill out the T777 Form online, ensuring you understand each section and what is required.

Follow the steps to complete the T777 Form online accurately.

- Press the ‘Get Form’ button to access the T777 Form and open it in your preferred digital editor.

- Begin by entering your personal information, including your name and address, as required at the top of the form. Ensure that this information is accurate and matches your legal documents.

- Proceed to the expenses section. You'll need to categorize your costs according to the provided categories such as accounting fees, advertising, and motor vehicle expenses. Be sure to check the appropriate box and provide accurate amounts.

- For motor vehicle expenses, you will enter details such as the make, model, and year of the vehicle. Record the kilometers driven for employment purposes, the total kilometers, and provide your associated expenses like fuel, maintenance, and insurance.

- Calculate your total expenses by summing all amounts from the various categories listed. This total will be entered on the designated line in the form.

- If applicable, complete the work-space-in-the-home section, detailing expenses related to your home office setup. Ensure you calculate the employment-use portion accurately.

- Review your capital cost allowance information if you are claiming depreciation on any tools or vehicles. Fill out the relevant sections as indicated, ensuring to follow the guidelines specified in the form.

- Once you have filled out all relevant sections and double-checked your information, you can save your changes. Options may include downloading the form, printing it, or sharing it as necessary.

Start filing your T777 Form online today to ensure you maximize your eligible employment expenses.

Form T777S or Form T777 must be filed with your tax return. Do not include your supporting documents. Form T2200S or Form T2200 is kept by you and is not included with your tax return. Form T2200 and Form T2200S must be signed by your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.