Loading

Get Fw8ben

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fw8ben online

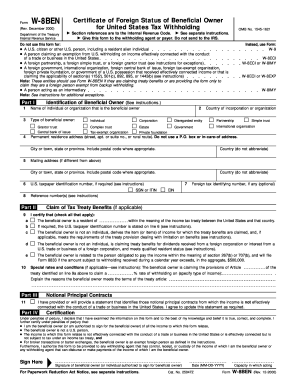

The Fw8ben form is essential for foreign individuals or entities to certify their status as beneficial owners and claim any applicable tax treaty benefits. This guide provides step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to successfully complete the Fw8ben form.

- Press the ‘Get Form’ button to retrieve the Fw8ben form and open it in the form editor.

- Provide your name in line 1, specifying whether you are an individual or an organization. Ensure that this accurately represents the beneficial owner's identity.

- In line 2, enter the country of incorporation or organization, or indicate 'N/A' if you are an individual.

- On line 3, select your type of beneficial owner by checking the appropriate box, such as individual, corporation, or partnership.

- Fill in your permanent residence address in line 4, ensuring that it is accurate and does not include a P.O. Box.

- If your mailing address differs from your permanent address, complete line 5 with your mailing details.

- Provide your U.S. taxpayer identification number, if applicable, in line 6.

- If you have a foreign tax identifying number, include it in line 7; this is optional.

- Line 9 involves certifying certain claims regarding tax treaty benefits. Select the applicable boxes corresponding to your claims.

- In line 10, provide additional details if required. This may reference treaty benefits that are not covered in previous lines.

- Lastly, sign and date the form in Part IV, certifying the accuracy of the information provided.

- Once finalized, save your changes. You can download, print, or share the form as needed.

Complete the Fw8ben form online today to ensure your compliance with U.S. tax regulations.

Why Does the IRS Require Form W-8BEN? The Internal Revenue Service requires W-8BEN because foreign individuals are normally subject to a 30% tax withholding, but they may qualify for a reduced rate of taxation. W-8BEN helps to establish this eligibility, although other factors also play a role, such as type of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.