Loading

Get Form 8453-ol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8453-OL online

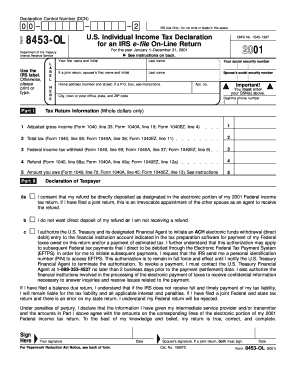

Form 8453-OL is a U.S. Individual Income Tax Declaration required for those filing electronically. This guide provides clear and detailed instructions on how to complete this form online, ensuring a smooth filing process.

Follow the steps to fill out the Form 8453-OL effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the top left corner, enter your Declaration Control Number (DCN). This is a 14-digit number provided by your tax preparation software, with the first two digits always being '00'.

- Fill out your name and home address accurately. If you received a peel-off name and address label from the IRS, place it in the designated area. If not, type or print your information clearly.

- Provide your Social Security Number (SSN) in the appropriate space. If filing jointly, include your spouse's SSN in the same order as their name.

- Complete Part I by entering your tax return information. Fill in the adjusted gross income, total tax, federal income tax withheld, refund amount, and the amount owed using the corresponding lines from your Form 1040, 1040A, or 1040EZ.

- In Part II, declare your preferences for refund deposit and payment authorizations. Make sure to check all applicable boxes regarding direct deposit or electronic funds withdrawal.

- Provide your signature and the date in the designated area. If filing a joint return, your spouse must also sign.

- Review all filled sections for accuracy. Once confirmed, save your changes, download the form if necessary, and prepare to mail it to the IRS as instructed.

Start filling out your Form 8453-OL online for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form FTB 8879, California e-file Signature Authorization for Individuals, must be completed when an individual e-file tax return is being signed using the Practitioner PIN method.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.