Loading

Get Sba 2483 Esign

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba 2483 Esign online

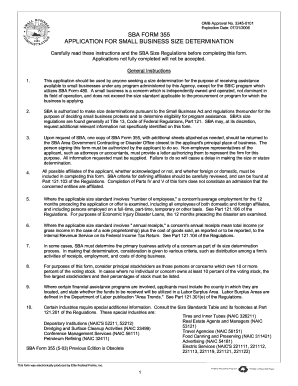

The Sba 2483 Esign form is essential for small business owners seeking federal assistance. This guide provides a clear and concise approach to filling out the form online, ensuring all necessary information is accurately captured.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and access it in the online platform.

- Fill in the applicant's name and address in the designated fields, ensuring accuracy and completeness.

- Provide the name and title of a person authorized to offer further information, including their contact details.

- Indicate the county where the applicant is located and if the assistance funds will be used in a labor surplus area by selecting 'Yes' or 'No'.

- Select the purpose of the size determination request from the provided options, such as HUBZone or Economic Injury Disaster Loan.

- Include the date when the applicant's business was established, attaching necessary documentation if applicable.

- Describe the overall primary business activity along with the corresponding North American Industry Classification (NAIC) code.

- List the applicant's major products or services, along with their respective sales shares for the most recently completed fiscal year.

- Complete the information about any franchise, license, or contractual agreements, attaching copies of relevant agreements as required.

- Provide details of the ownership structure, including names and addresses of owners, partners, and principal stockholders.

- Review the completed form for accuracy. Once satisfied, save your changes, download a copy, and share it as necessary.

Ensure your Sba 2483 Esign form is complete and accurate by following these steps online.

Related links form

Most large banks have yet to launch their PPP loan application, and it appears that nearly all of the large banks are planning to do this process entirely online and that initially they will only work with their existing business-banking customers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.