Loading

Get Specimen Form For Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Specimen Form For Mortgage online

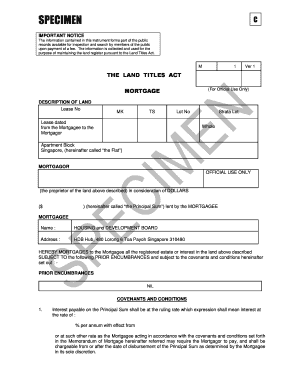

Filling out the Specimen Form For Mortgage online is a crucial process for borrowers seeking to secure financing for their property. This guide is designed to help you navigate each section of the form with clarity and confidence.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the description of land, including lease number, lot number, and lease date in the designated fields. Ensure that this information accurately reflects your property details.

- Fill in the details of the mortgagor, which includes providing the name and address. Ensure you are the legal owner of the property listed above.

- Complete the mortgagee section by entering ‘Housing and Development Board’ under the name field and its official address.

- Specify the principal sum you wish to borrow in the appropriate field, ensuring that the numeric value is accurate and clearly written.

- Indicate the interest rate you agree to by entering the percentage in the designated field. Be clear about when the effective date begins.

- Detail the payment schedule for the principal amount and interest, including the amount of monthly installments and the start date for payments.

- Review the covenants and conditions section. Make sure you understand each obligation regarding tax and repayment.

- Finalize the document by signing the execution section, along with a witness signature, if required.

- Once you have completed all sections, save your changes. Depending on your preference, you can download, print, or share the completed form.

Get started on completing your documents online today.

Related links form

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.