Loading

Get Cp567

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp567 online

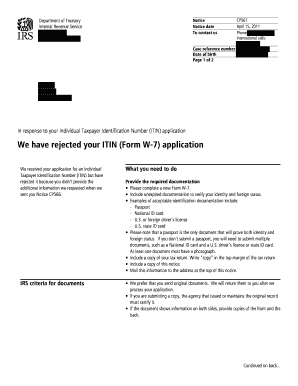

The Cp567 notice from the Internal Revenue Service informs you of the rejection of your Individual Taxpayer Identification Number (ITIN) application. This guide provides a clear, step-by-step approach to filling out the necessary components to rectify this situation online.

Follow the steps to effectively complete the Cp567 form online.

- Press the ‘Get Form’ button to obtain the document and open it in the appropriate editor.

- Review the notice date and your case reference number included on the form to ensure accuracy.

- Complete a new Form W-7, which is required to support your ITIN application. Make sure all fields are filled out accurately.

- Gather the necessary original or certified copies of documents to verify your identity and foreign status. Acceptable documents include a passport, National ID card, and a U.S. or foreign driver’s license.

- If you are not submitting a passport, ensure that you provide a combination of documents that includes at least one with a photograph.

- Prepare a copy of your tax return and write ‘copy’ in the top margin.

- Include a copy of the Cp567 notice in your submission.

- Once you have completed the necessary forms and gathered your documents, mail them to the address provided at the top of the notice.

Complete your documents online to ensure a smooth submission process.

If the ITIN process was never completed by responding to the IRS denial with the corrected information, then you should correct the application and return it to them. ... Note: The return for last year will need to be amended after the ITIN is actually received.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.