Loading

Get Ph Bir Form 1601-c 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 1601-C online

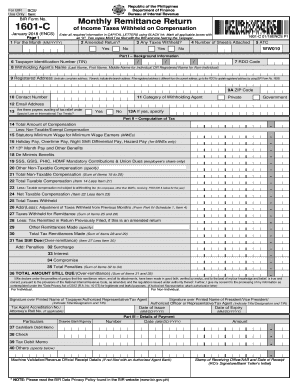

Filing the PH BIR Form 1601-C online is essential for withholding agents to report the income taxes withheld on compensation. This guide provides a detailed, step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to effectively complete the PH BIR Form 1601-C online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin filling out Part I – Background Information. Enter the ‘For the Month’ (MM/YYYY) in the first field. If this is an amended return, mark 'Yes' or 'No' accordingly in the second field.

- Indicate whether there were any taxes withheld by selecting 'Yes' or 'No' in the third field. Enter the number of sheets attached in the fourth field.

- Fill in the ATC code, your Taxpayer Identification Number (TIN), and the withholding agent’s name. Make sure to provide the registered address with the corresponding ZIP code and contact number.

- Specify your category of withholding agent by selecting 'Private' or 'Government'. Include your email address and indicate if there are payees availing of tax relief under a Special Law or International Tax Treaty by selecting 'Yes' or 'No'. If 'Yes,' provide further details.

- Move to Part II – Computation of Tax. Fill out the total amount of compensation and list non-taxable/exempt compensations. Calculate the totals for each relevant category, including statutory minimum wages and other applicable compensations.

- Proceed to calculate the total taxes withheld and any adjustments from previous months as instructed in the respective fields of the form. Record total remittances and any penalties if applicable.

- Finally, review all entries for accuracy. Save any changes made, and choose to download, print, or share the completed form as required.

Complete your documents online today to ensure timely compliance.

To those who don't know what BIR Form 1601C is, it's a form you have to file each month when you have employees. And the exact name the BIR gave this form is the Monthly Remittance Return of Income Taxes Withheld on Compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.