Loading

Get Il Lr 4 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LR 4 online

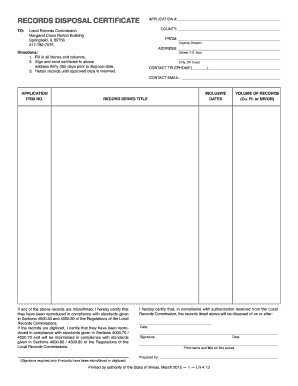

Filling out the IL LR 4 form is an important step for managing records disposal in Illinois. This guide will provide you with comprehensive instructions to complete the form accurately and effectively.

Follow the steps to complete the IL LR 4 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the Application Number field by entering the unique identifier associated with your records disposal request.

- Fill in the County field with the name of the county where your agency operates.

- In the FROM section, enter the name of your agency division.

- Provide the ADDRESS details including Street, P.O. Box, City, and ZIP Code.

- Include the contact telephone number, ensuring it is complete and accurate.

- Enter your contact email address for any correspondence regarding this application.

- Specify the RECORD SERIES TITLE for the items you will be disposing of.

- If any records are microfilmed, affirm compliance by checking the corresponding box and providing a signature if necessary.

- If records have been digitized, please certify compliance with the digitization standards and provide a signature if required.

- In the INCLUSIVE DATES section, record the date you intend to begin disposal of the records.

- Indicate the VOLUME OF RECORDS, detailing the amount in cubic feet or MB/GB.

- Finally, sign and date the form, ensuring that you also print your name and title above the signature line.

- Save your changes, then download, print, or share the completed form as needed.

Complete your IL LR 4 form online to ensure efficient records management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

4 form is filled out for the state of Illinois to determine the correct amount of state income tax to withhold from your paycheck. This helps you avoid underpayment or overpayment of taxes throughout the year. Additionally, compliance with IL LR 4 ensures you meet state regulations regarding tax withholding. For assistance in completing the form correctly, explore the USLegalForms platform for reliable tools and templates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.