Loading

Get Mo Modes-4 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MODES-4 online

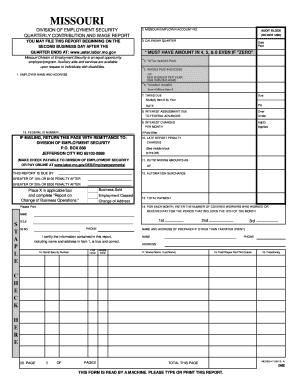

Filling out the MO MODES-4 form is an essential task for employers to report quarterly contributions and wages. This guide provides a step-by-step approach to help users complete the form accurately and efficiently in an online format.

Follow the steps to fill out the MO MODES-4 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer name and address in Item 1. Ensure that all information is accurate and formatted correctly.

- In Item 2, input your Missouri employer account number. This number is crucial for identifying your business.

- Specify the calendar quarter for which you are reporting in Item 3. Ensure that the date corresponds to the end of the quarter.

- Complete Item 4 by entering the total wages paid during the quarter. Be sure to include the amount even if it is 'zero'.

- In Item 5, indicate the wages paid in excess of the specified limit per worker per year. This information is essential for calculating taxable wages.

- Calculate taxable wages by subtracting the amount in Item 5 from the total in Item 4. Enter this figure in Item 6.

- In Item 7, enter the taxes due. This is calculated by multiplying the taxable wages from Item 6 by your applicable rate.

- Complete Item 8 by entering any interest assessment due over federal advances based on your payment history.

- Input any interest charges in Item 9, adjusting for any payments made after the due date.

- If applicable, fill out the late report penalty charges in Item 10 according to the guidelines provided on the form.

- For outstanding amounts and automation surcharge, provide relevant details in Items 11 and 12 respectively.

- Indicate any changes related to your business operations in the relevant boxes if necessary.

- Record the number of covered workers in Item 14 who worked or received pay during the specified period.

- Complete your certification in Items 15 to 20 by providing your contact details and signing the form to confirm its accuracy.

- Once all sections are completed, save the changes, download, print, or share the completed form as needed.

Complete your MO MODES-4 form online today for timely reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out an unemployment application in Missouri involves several steps, including gathering your personal information and work history. You will need to provide reasons for your job loss and any relevant documentation. For a smoother experience, consider leveraging the Uslegalforms platform, which offers guided assistance in completing your application correctly. This approach helps you maximize your chances of approval.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.