Loading

Get Hud-11706 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HUD-11706 online

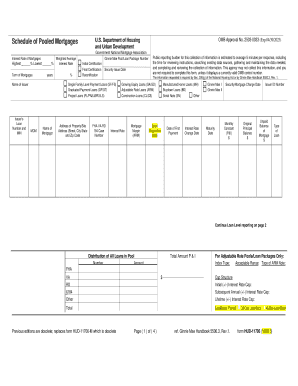

The HUD-11706 is a critical form used in the management of pooled mortgages by the U.S. Department of Housing and Urban Development. This guide will walk you through the process of filling out the form online, ensuring you include all necessary information accurately and efficiently.

Follow the steps to fill out the HUD-11706 successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering the name of the issuer, which is essential for identifying the mortgage pool. Ensure that this information is accurate.

- Fill in the loan number and the Mortgage Identification Number (MIN) associated with the relevant mortgage, providing a clear reference to the transaction.

- Input the security issue date, which indicates when the securities associated with the pooled mortgages were issued.

- Complete the section regarding the interest rates. Enter the highest, lowest, and weighted average interest rates for the mortgages included in the pool.

- For each mortgage listed, fill out the loan origination date, date of first payment, and any adjustable rate mortgage details, including the margin and change date.

- If applicable, provide details for specific loan types, such as single-family level payment loans and graduated payment loans, ensuring all boxes are checked as necessary.

- Input borrower details, including names and social security numbers, for all co-borrowers, following privacy guidelines where applicable.

- Confirm any loan type codes and purposes as required by the guidelines, ensuring all classifications match the loans listed.

- After filling out all required sections, review all information for accuracy. Save changes and choose to download, print, or share the completed form as needed.

Start filling out the HUD-11706 online today to streamline your mortgage management process.

Related links form

The law of mortgages is mainly governed by state statutory and common law. Mortgages are regulated by federal or state law or agencies depending on under whose law they were chartered or established.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.