Loading

Get Oh 37-stores 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH 37-STORES online

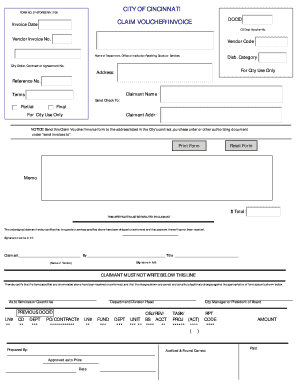

This guide provides a detailed overview of how to complete the OH 37-STORES online form effectively and accurately. By following the instructions below, users can ensure a smooth process when submitting their claims or invoices.

Follow the steps to complete the OH 37-STORES form successfully.

- Press the ‘Get Form’ button to access the OH 37-STORES form and open it in your preferred online editor.

- In the 'Name of Department, Office or Institution Receiving Goods or Services' field, enter the official name of the department or institution to which the goods or services have been provided.

- Locate the section titled 'Claim Voucher/Invoice' and fill in the vendor's name and address accurately to ensure the invoice is directed appropriately.

- In the 'Invoice Date' field, input the date when the invoice is being submitted. This date is crucial for processing and payment timelines.

- Provide the contract, purchase order, or agreement number that corresponds with the services or goods provided. This can typically be found in the City's previous documentation related to the transaction.

- Detail the total amount being claimed in the '$ Total' field. Ensure this figure matches the amounts indicated in any corresponding invoices or documents.

- In the section for signatures, the claimant must sign in ink and print their name. This certifies that the goods or services have been delivered as specified.

- Review all information for accuracy before proceeding to save your changes. Once confirmed, you can download, print, or share the form as required.

Complete your documents online for quick and efficient processing.

Line 27 on the tax return typically captures specific income or deductions that affect your overall tax liability. Understanding what belongs on line 27 can be crucial for accurate tax reporting. Tools like US Legal Forms can offer clarity on how to properly include income on your tax return using line 27.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.