Loading

Get After-tax Wages From A Job

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the After-Tax Wages From A Job online

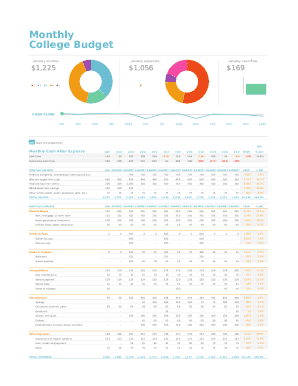

Filling out the After-Tax Wages From A Job form is essential for accurately reporting your earnings. This guide will provide you with step-by-step instructions to help you complete this form online with ease.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your monthly after-tax wages. Locate the section labeled 'After-tax wages from a job' and input your income for each month clearly.

- For each month, ensure you accurately reflect your total earnings after any deductions or taxes have been applied. This information is critical for your overall budgeting and financial records.

- Check the cumulative cash flow section to see how your after-tax wages influence your overall financial situation. Make sure that these numbers align with your personal records.

- Once all values are entered, review each section to confirm accuracy. Check for any inconsistencies or missing information.

- Finally, once you are satisfied with the completed form, you can save changes, download, print, or share the form as necessary.

Start filling out your documents online today to manage your finances more effectively.

Take the operating profit from the income statement and subtract any interest payments, then add any interest earned. PBT is generally the first step in calculating net profit but it excludes the subtraction of taxes. To calculate it in reverse you can also add taxes back into the net income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.