Loading

Get Employee Payroll Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Payroll Template online

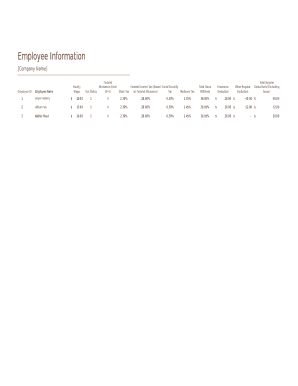

Filling out the Employee Payroll Template online is a straightforward process that allows employers to track employee wages and deductions accurately. This guide will walk you through each section of the template, ensuring you understand how to complete it correctly and efficiently.

Follow the steps to fill out the Employee Payroll Template online:

- Press the ‘Get Form’ button to access the Employee Payroll Template and open it in your preferred editing tool.

- Begin by filling in the company name at the top of the template, ensuring accuracy as this identifies the payroll data.

- Enter the Employee ID for each employee. This unique identifier helps in tracking individual payroll records.

- Input the employee name clearly in the designated field to ensure proper identification.

- Specify the hourly wage for each employee in the appropriate section, using a dollar amount.

- Indicate the employee's tax status by selecting or entering the relevant information, as this affects their withholdings.

- Enter the federal allowance from the employee's W-4 form, which is necessary for calculating tax withholdings.

- Fill in the state tax amount based on the federal allowance and applicable state tax rates.

- Record Medicare and Social Security tax rates as percentages to determine the total taxes withheld from each paycheck.

- Document any insurance deductions or other regular deductions in their designated fields.

- Once all fields are filled out, review the total regular deductions, including total taxes and other deductions.

- At the end of the form, save changes to preserve the information entered. You can then download, print, or share the completed Employee Payroll Template.

Complete your Employee Payroll Template online today to ensure accurate payroll processing.

Free Corporate Pay Stub Template You can easily edit our templates in all versions of Microsoft Word. Our files are ready-made and 100% customizable to suit your preferences. This professionally-written template isn't just limited to a computer. It can be viewed and editable on your tablet and phone as well.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.