Loading

Get Strght Line Depreciation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Strght Line Depreciation Form online

Filling out the Strght Line Depreciation Form online is a straightforward process that ensures your assets are accurately recorded and depreciated. This guide provides step-by-step instructions to help you navigate each section of the form with ease.

Follow the steps to complete your Strght Line Depreciation Form online.

- Click the ‘Get Form’ button to access the Strght Line Depreciation Form and open it in your editing tool.

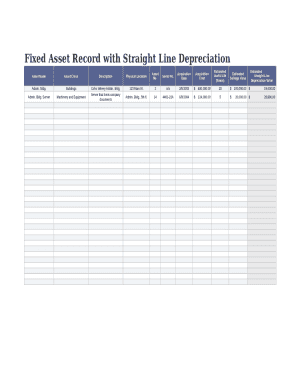

- Begin by entering the 'Asset Name' in the designated field. This should be the name of the asset you are depreciating, such as 'Admin. Bldg.' or 'Coho Winery Admin. Bldg.'

- Next, specify the 'Asset Class.' Choose the appropriate category, like 'Buildings' or 'Machinery and Equipment,' to classify your asset correctly.

- In the 'Description' section, provide a brief note about the asset, summarizing its purpose or any relevant details.

- Fill out the 'Physical Location' field with the address where the asset is located, for instance, '123 Main St.'

- Enter the 'Asset No.' for internal tracking. This can be a unique identifier for assets in your inventory system.

- Provide the 'Serial No.' if applicable, which is important for warranty and service purposes.

- Indicate the 'Acquisition Date' of the asset. This should be the date when the asset was purchased or put into use.

- Input the 'Acquisition Cost' reflecting the total amount spent on acquiring the asset, formatted correctly in currency.

- Estimate the 'Estimated Useful Life (Years)' of the asset. This is how many years you expect to use the asset before it needs replacement.

- Fill in the 'Estimated Salvage Value,' which is the expected value of the asset at the end of its useful life.

- Calculate and enter the 'Estimated Straight-Line Depreciation Value.' This is typically determined by dividing the depreciable base (acquisition cost minus salvage value) by the useful life.

- After filling in all the fields, ensure to review your entries for accuracy. Once completed, you can save your changes, download the form, print a copy for your records, or share it as needed.

Start filling out your Strght Line Depreciation Form online today for efficient asset management.

Straight-line is a depreciation method that gives you the same deduction, year after year, over the asset's useful life. ... Because most business property is depreciated with MACRS, that's the method that TurboTax applies by default.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.