Loading

Get Four Year Profit Projection

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Four Year Profit Projection online

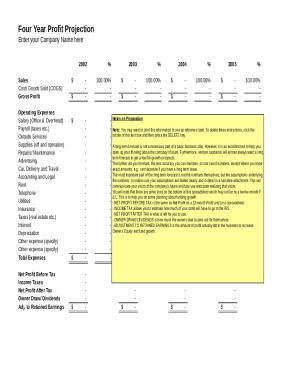

Filling out the Four Year Profit Projection is an essential step in financial planning for your business. This guide provides a clear and structured approach to completing the form online, ensuring you can effectively project your company's financial performance over the next four years.

Follow the steps to successfully complete your Four Year Profit Projection.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your company name in the provided field to clearly identify the profits associated with your business.

- Begin filling in the sales figures for each of the four years. Make sure to provide realistic forecasts based on your business's past performance and market analysis.

- Input the Cost of Goods Sold (COGS) for each year, ensuring it aligns with your projected sales figures.

- Calculate the Gross Profit by subtracting COGS from Sales. This figure will be key in assessing your profitability.

- List all Operating Expenses such as salaries, payroll taxes, outside services, and supplies in the designated fields.

- Continue detailing your expenses, including advertising, car-related costs, accounting, legal fees, rent, utilities, insurance, and any other relevant costs over the forecasting period.

- Once all expenses are accounted for, calculate Total Expenses by summing all listed costs.

- Determine Net Profit Before Tax by subtracting Total Expenses from Gross Profit.

- Estimate Income Taxes, which gives an indication of how much profit you will need to allocate to taxes.

- Compute Net Profit After Tax by subtracting Income Taxes from Net Profit Before Tax.

- Indicate the amount for Owner Draw/Dividends, reflecting what the owners plan to extract from the business.

- Complete the section for Adjustment to Retained Earnings, capturing the portion of profit that will remain in the business.

- Review and ensure all figures are accurate. Save your changes, and choose to download, print, or share the completed form as needed.

Take the first step in your financial planning by completing your Four Year Profit Projection online today.

Start with the business's projected sales income. Subtract the cost of goods sold to get the gross margin. Subtract other operating expenses to get net operating income, then subtract any interest payments due to get your net income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.