Loading

Get Accounts Payable Log

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Accounts Payable Log online

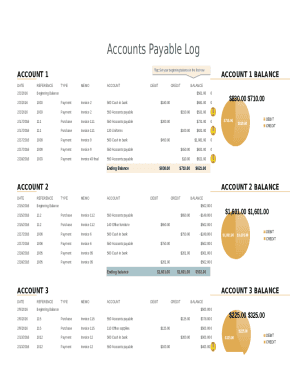

The Accounts Payable Log is an essential tool for tracking all transactions related to accounts payable. This guide provides clear, step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to complete the Accounts Payable Log accurately.

- Click ‘Get Form’ button to access the Accounts Payable Log and open it in your preferred online editor.

- Begin by entering the beginning balance in the first row of the log. This forms the foundation of your tracking and should reflect the total amount owed at the start of your recording period.

- Under the 'DATE' column, input the date of each transaction. Ensure that the dates are formatted consistently throughout the log.

- In the 'REFERENCE' section, provide any relevant details, such as invoice numbers. This will help you easily identify each transaction later.

- In the 'ACCOUNT' column, specify the account associated with each transaction, using position numbers like '1003' for accurate record-keeping.

- Fill out the 'MEMO' field with descriptive notes for each transaction, such as 'Payment for Invoice 2' or 'Purchase of Office Supplies'. This aids in clarity and accountability.

- Input the amounts in the 'DEBIT' and 'CREDIT' columns as they pertain to each transaction. Ensure to maintain the balance accurately after every entry.

- Double-check all entries for accuracy before finalizing the log. Look for any discrepancies in the dates, amounts, or categories.

- Once all information is complete and verified, save your changes. You may then choose to download, print, or share the form as needed.

Complete your Accounts Payable Log online today for effective financial management.

To record accounts payable, the accountant credits accounts payable when the bill or invoice is received. The debit offset for this entry is typically to an expense account for the good or service that was purchased on credit. The debit could also be to an asset account if the item purchased was a capitalizable asset.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.