Loading

Get Capital Budget Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Capital Budget Template online

The Capital Budget Template is a vital tool for managing financial decisions related to investments. This guide offers step-by-step instructions to help users efficiently complete the template online, ensuring accuracy and clarity in their budget planning.

Follow the steps to fill out the Capital Budget Template accurately online.

- Click ‘Get Form’ button to obtain the template and access it in the online editor.

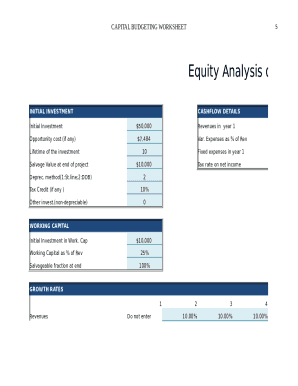

- Fill in the initial investment section by entering the total amount planned for the investment. Include opportunity costs, the expected lifetime of the investment, salvage value at the end of the project, and choose the depreciation method applicable.

- In the Cashflow Details section, provide expected revenues for year one and specify variable and fixed expenses as percentages of revenues. Include the applicable tax rate on the net income.

- Complete the Working Capital section by inputting the initial investment in working capital and the percentage of working capital relative to revenue.

- Enter growth rates for revenues and fixed expenses as applicable, ensuring to follow the pre-set defaults for growth rates where necessary.

- Review the investment measures calculated at the end of the form, including NPV and IRR, to assess the investment's viability.

- Once all sections are filled out, save your changes. You may choose to download, print, or share the completed form for your records.

Complete your Capital Budget Template online today for effective financial planning.

Capital budgeting involves identifying the cash in flows and cash out flows rather than accounting revenues and expenses flowing from the investment. For example, non-expense items like debt principal payments are included in capital budgeting because they are cash flow transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.