Loading

Get Nc Revocable Living Trust 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC Revocable Living Trust online

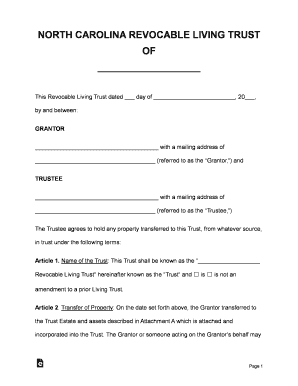

Creating a North Carolina revocable living trust is a crucial step in managing your assets and planning for the future. This guide will provide you with a comprehensive step-by-step process to complete the trust form online, ensuring that you understand each component clearly.

Follow the steps to effectively complete your trust form.

- Click ‘Get Form’ button to access the NC Revocable Living Trust form, and open it in your preferred editor.

- Fill in the date at the top of the form where indicated. This should reflect the day you are executing the trust. Then, provide the names and mailing addresses of the Grantor and Trustee. Ensure that these individuals are clearly identified as the ones who will create and manage the trust.

- In Article 1, name your trust. This identification is important and should reflect your intention, ensuring it is unique and easily recognizable. Indicate whether this trust is an amendment to any prior living trust if applicable.

- Proceed to Article 2 to detail the transfer of property into the trust. Attach a list of assets as described in Attachment A and specify how property can be transferred, ensuring clarity about what constitutes part of the Trust Estate.

- In Article 3, outline the provisions for the life of the Grantor, detailing how the Trustee should manage the trust assets during the Grantor's lifetime.

- Article 4 requires you to outline the distributions upon the death of the Grantor. Here, provide specific instructions on how property should be allocated to beneficiaries. Include detailed information about personal property, pet care arrangements, and alternate beneficiaries if needed.

- For Article 5, specify the payment of any death taxes and administrative expenses that should be covered after the Grantor’s death. This ensures clarity on how funds will be handled.

- Continue through the articles, ensuring you understand the powers granted to the Trustee, as outlined in Articles 7 and 9, and any specific terms or conditions in the remaining articles. For Articles addressing incapacity and succession, accurately outline details that align with your intentions.

- Fill in the names and addresses for any successor trustees as designated in Article 13. Ensure you consider any potential conflicts or necessary consultations here.

- Complete the signature section at the end of the form, where the Grantor, Trustee, and any successor trustees will acknowledge their roles and agreement to the terms outlined in the trust.

- Finally, save your completed document. You can choose to download, print, or share the form as needed.

Start filling out your NC Revocable Living Trust online today to safeguard your assets and ensure your wishes are honored.

Related links form

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.