Loading

Get Ma 355-7004 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA 355-7004 online

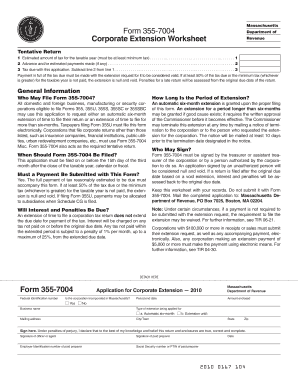

The MA 355-7004 form, also known as the Corporate Extension Worksheet, is essential for corporations seeking to extend their tax return filing deadline. This guide will help users navigate the online process with clear, step-by-step instructions, ensuring a smooth completion of the form.

Follow the steps to complete the MA 355-7004 online.

- Click the ‘Get Form’ button to access the MA 355-7004 form and open it within the online editor.

- Begin by entering your federal identification number at the designated field. This number is crucial for identifying your corporation.

- Indicate whether the corporation is incorporated in Massachusetts by selecting 'Yes' or 'No' in the provided options.

- Input the period end date for your corporation's tax year. Ensure the date is accurate to avoid processing delays.

- Fill in the business name clearly in the respective field to distinguish your corporation.

- Select the type of extension you are applying for: choose either 'Automatic six-month' or specify an 'Extension until' date if applicable.

- Provide the mailing address, including city/town, state, and zip code, ensuring it is up-to-date for correspondence.

- Sign the form electronically. The signature should be by an officer or agent of the corporation, verifying the accuracy of the information provided.

- If you have used a paid preparer, enter their signature and details, including their Employer Identification Number and Social Security number or PTIN.

- Review all entered information for accuracy and completeness before you submit your application. You may save changes, download, or print a copy for your records.

Complete your MA 355-7004 document online now to ensure timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain MA state tax forms from the Massachusetts Department of Revenue’s official website. They provide a wide range of forms, including the MA 355-7004, which can be downloaded and printed. Physical copies may also be available at select government offices. Utilizing uslegalforms helps streamline your search for all required forms and documentation you might need.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.