Loading

Get Irs 1040 - Schedule 3 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 3 online

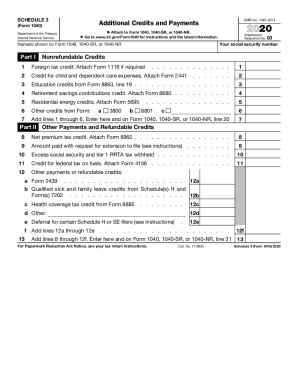

Filling out the IRS 1040 - Schedule 3 online can be a straightforward process with the right guidance. This form is used for reporting additional credits and payments that may apply to your federal tax return. By following these steps, you can ensure that you accurately complete this important document.

Follow the steps to successfully complete the IRS 1040 - Schedule 3 online.

- Click the ‘Get Form’ button to access the IRS 1040 - Schedule 3 document and open it in your preferred online editor.

- Enter your social security number in the designated field. This information is critical for the IRS to accurately identify your tax return.

- Provide the names shown on your Form 1040, 1040-SR, or 1040-NR. Ensure that the names match exactly as they appear on those forms.

- In Part I, begin filling out additional credits and payments. Start with line 1 for the foreign tax credit. If necessary, attach Form 1116.

- Continue through each field. For line 2, specify the credit for child and dependent care expenses by attaching Form 2441 if required.

- Move to line 3 to report education credits from Form 8863, ensuring that you input the correct amount.

- On line 4, indicate if you are claiming the retirement savings contributions credit and attach Form 8880 if applicable.

- For line 5, if you qualify for residential energy credits, make sure to attach Form 5695.

- On line 6, include any other credits from various forms. Ensure accuracy to avoid delays in processing.

- Add the amounts from lines 1 through 6 and enter the total on the designated line. This total will be transferred to your main Form 1040.

- In Part II, report additional payments and refundable credits, starting with line 8 for any net premium tax credits. Attach Form 8962 if necessary.

- Follow through lines 9 to 13, entering the amounts for other payments, including amounts paid with an extension request and any excess social security tax withheld.

- Complete the calculations and total required amounts on line 13. This total will also be transferred to your main Form 1040.

- Finally, save the document with any changes made, and you may choose to download, print, or share the completed Schedule 3 for your records.

Complete your IRS 1040 - Schedule 3 online today for a smooth tax filing experience.

Schedule 3 was added in tax year 2018 to report a taxpayer's Nonrefundable Credits. Starting in tax year 2019, Schedules 3 and 5 are combined on to a single Schedule 3 Additional Credits and Payments. Line numbers have also been rearranged.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.