Loading

Get Irs 2848 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2848 online

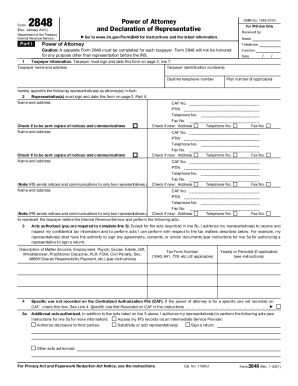

The IRS 2848 form, also known as the power of attorney and declaration of representative, allows taxpayers to authorize individuals to represent them before the IRS. This guide provides clear instructions to help users fill out the form online with confidence.

Follow the steps to complete the IRS 2848 online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- In Part I, enter the taxpayer's name, identification number, and contact details. Ensure all information is accurate and complete. Remember, the taxpayer must sign and date the form on page 2.

- List the representative(s) being appointed in Part I, including their names and addresses. Check the box if they should receive copies of notices and communications.

- In line 3, specify the acts authorized for the representative(s) to perform, such as receiving confidential tax information and signing documents.

- Detail the specific matters in which the representative is authorized to act, including relevant tax form numbers and periods associated with these matters.

- If applicable, check the box for specific use not recorded on the Centralized Authorization File.

- In line 5a, specify any additional acts the representative is authorized to perform, including authorizing disclosures and adding representatives.

- In line 6, indicate any specific acts that are not authorized for the representative(s) to perform.

- Complete the taxpayer declaration and signature in Part II. Ensure that if a joint return was filed, each spouse must submit a separate power of attorney.

- Finalize the form by saving your changes, downloading, printing, or sharing the completed document as needed.

Complete your IRS 2848 form online today and ensure proper representation before the IRS.

Submit Your Form Log in with your username, password, and multi-factor authentication. Answer a few questions about the form that will be submitted. ... Upload a completed version of a signed Form 8821 or Form 2848. ... To submit multiple forms, select “submit another form" and answer the questions about the authorization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.