Loading

Get Ar Statement Of Financial Interest 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Statement of Financial Interest online

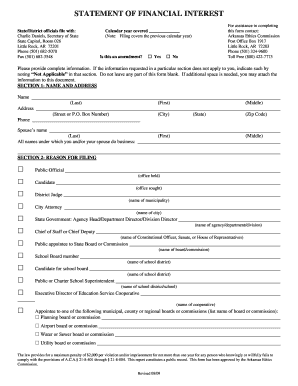

The AR Statement of Financial Interest is a crucial document required by Arkansas officials to disclose financial information. This guide will help users navigate the process of completing this form online with clarity and support.

Follow the steps to successfully complete your AR Statement of Financial Interest online.

- Click the ‘Get Form’ button to obtain the AR Statement of Financial Interest form and open it accordingly.

- Begin by filling out the calendar year covered section. Indicate the previous calendar year relevant to your filing.

- In Section 1, provide your full name, address, and phone number. Also, include details regarding your spouse if applicable, along with any business names.

- Proceed to Section 2, where you should identify the reason for filing by checking the appropriate box, such as 'Public Official' or 'Candidate.'

- In Section 3, list each source of income exceeding $1,000, entering the employer's name, address, and the nature of the services for which compensation was received.

- Switch to Section 4 and list businesses or holdings where you or your spouse has an investment, including fair market value at the end of the reporting period.

- Section 5 requests you to list offices or directorships held by you or your spouse in any regulated business.

- In Section 6, note each creditor to whom you owe $5,000 or more, ensuring not to include debts to family members.

- Continue to Section 7, where you will list any guarantors or co-makers for debts outstanding, excluding family members.

- In Section 8, disclose gifts received over $100 or gifts to your dependent children valued over $250, including descriptions and values.

- Section 9 requires the listing of monetary or other awards received by employees of certain educational institutions.

- List any non-governmental sources of payment for your expenses related to your office in Section 10, if expenses exceed $150.

- In Section 11, document any businesses that employ you and are regulated by your governmental body.

- Detail goods or services sold to the governmental body in Section 12, providing comprehensive information for each entry.

- Finally, ensure you sign and date the form in Section 13 and have it notarized as required. Double-check for any applicable fines for non-compliance with the filing requirements.

- Once completed, you can save changes, download, print, or share your filled form.

Start completing your AR Statement of Financial Interest online today to ensure timely and accurate submission.

Interest payable shows up on the balance sheet as a current liability. This indicates what a company owes in interest payments and needs to settle soon. When creating your AR Statement of Financial Interest, including interest payable provides a comprehensive view of your financial obligations, enhancing transparency for stakeholders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.