Loading

Get Sba 3508s 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 3508S online

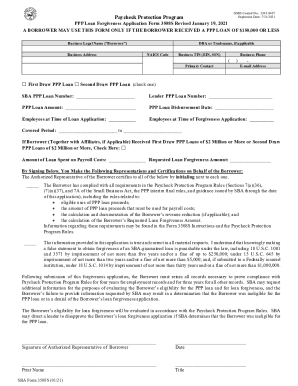

This guide offers a comprehensive overview of how to fill out the SBA 3508S form online. By following these steps, users can navigate the application process for loan forgiveness under the Paycheck Protection Program efficiently and accurately.

Follow the steps to complete your SBA 3508S application.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the business legal name in the designated field as listed on your Borrower Application Form. Ensure that the name matches exactly to avoid any discrepancies.

- Enter the business address, including any DBA or tradename if applicable, alongside the NAICS code to specify your business activity.

- Input your business TIN (EIN or SSN), primary contact details such as business phone number and email address to facilitate communication.

- Select whether the application is for a First Draw PPP Loan or Second Draw PPP Loan by checking the appropriate box.

- Enter the SBA PPP Loan number and the lender's PPP Loan number as provided during your loan approval.

- Input the total PPP Loan amount disbursed by your lender, along with the disbursement date.

- Document the number of employees at the time of both the loan application and the forgiveness application to reflect changes if any.

- Specify the covered period that begins on the loan disbursement date and ends at least 8 weeks later but no more than 24 weeks after.

- If applicable, indicate whether your business received First or Second Draw PPP Loans of $2 million or more by checking the box.

- Detail the amount of loan spent on payroll costs, based on your payroll calculations during the covered period.

- Enter the requested loan forgiveness amount, completing all necessary calculations required for eligible expenses.

- Read the certifications carefully, and ensure to initial each one to attest to compliance with the Paycheck Protection Program rules.

- After completing the form, save changes, and download or print the application for your records.

- Submit the completed form to your lender as part of the forgiveness application process.

Start completing your SBA 3508S application online today to ensure your loan forgiveness process is smooth and efficient.

To apply for loan forgiveness: 1. Contact your PPP Lender and complete the correct form: Your Lender can provide you with either the SBA Form 3508, SBA Form 3508EZ, SBA Form 3508S, or a Lender equivalent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.